Just like the seasons, the winds and temperatures of the financial markets change throughout the year. And, when the storms come, we all feel better about seeking refuge. The current market environment has not provided many opportunities for respite from the storm. Outside of cash, commodities, and the energy sector, almost all financial assets are down. Even typical shelters for volatile environments such as dividend stocks, treasuries, and TIPS have not been spared. But, this blog post isn’t about explaining why the market has done what it has done – you can check our videos and webinars for that. Let’s talk about what you should do now.

- Reframe the current market versus the long-term

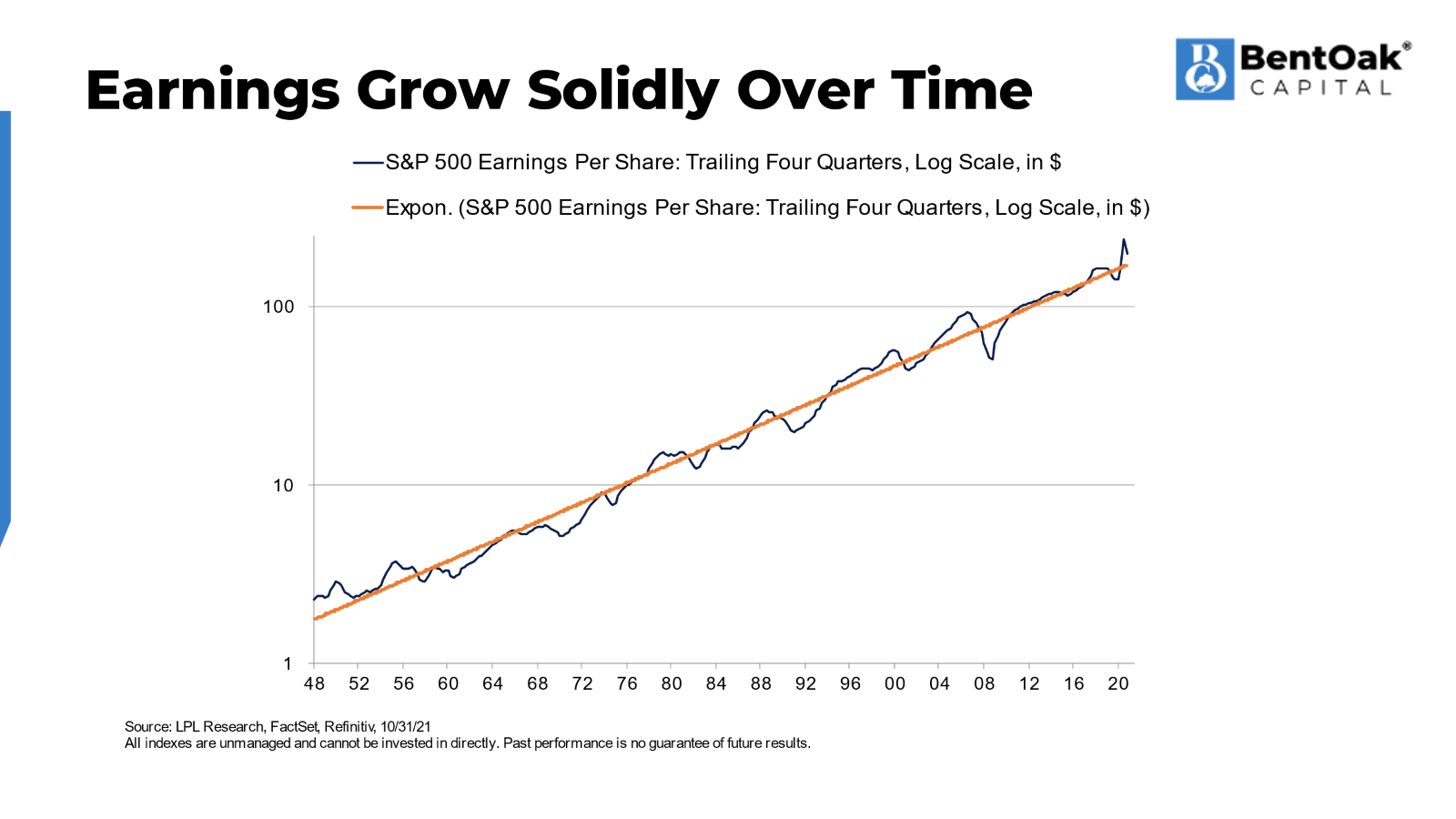

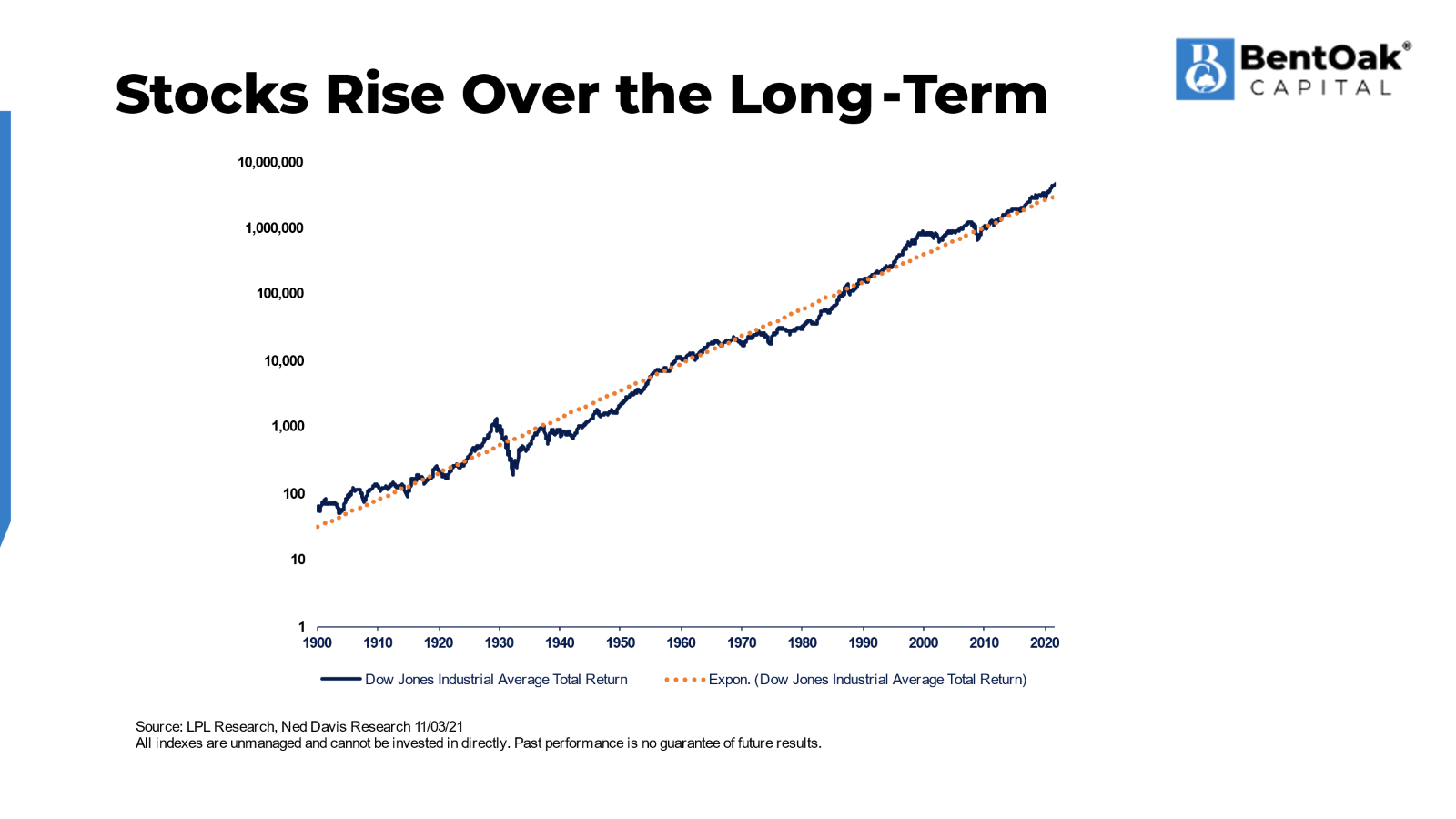

It’s important to consider what the stock and bond markets truly represent. If you are working with us or another financial professional to help manage your portfolio, you may not have given this a lot of thought in the past. The market to you may just be a barometer that somehow affects your monthly or quarterly statements. In times like this, it’s important to view markets in a broader & more long-term lens.The financial markets represent prices right now. The prices you would receive if you were to fire-sell everything at a single moment in time. If you aren’t selling, that means those aren’t your prices, those are their prices. The prices in the future mean far more to you. In volatile times, it is tempting to extrapolate the most recent events into the future. This is a phenomenon called “recency bias” – a known cognitive predisposition that clouds our judgment as human beings. We are hardwired to think that whatever has recently happened will continue for an indefinite amount of time, but history tells us that isn’t how the markets work.Here is what history tells us: the S&P 500 has annualized right at 10% over the last 100 years, and the stock market has a positive rate of return about 7 out of every 10 years. We currently find ourselves in one of those irritating time periods that occur about 30% of the time. It is paramount to understand that long-term investment success isn’t entirely dictated by the 70% – it’s weighted far more heavily toward how you behave during the 30%.Wall Street icon Benjamin Graham said, “In the short run, the market is a voting machine. In the long run, it is a weighing machine.” In other words, short-term volatility is mostly created by opinions of what could happen while long-term returns represent the fundamental strength and profitability of businesses. There is a strong and direct correlation between the long-term return of the stock market and corporate earnings.

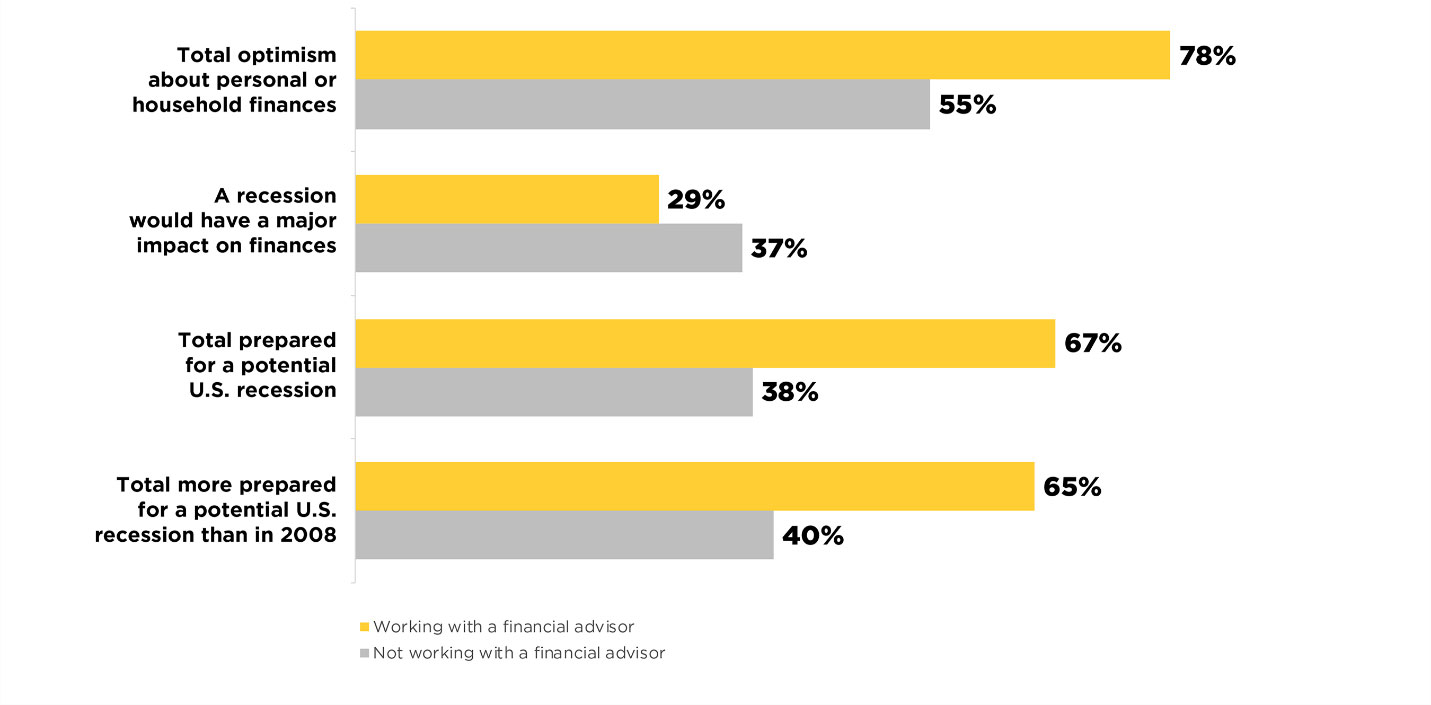

Understanding that stock and bond markets work over the long-term and being willing to experience some pain for long-term gains is a foundational frame of mind that is required to weather market storms. Much like pruning a tree, markets require occasional periods of setbacks to experience healthy long-term growth. - Rebalance your portfolioVolatility across almost all asset classes may present long-term opportunities. When markets are correcting, most people feel like they need to do something. Anything, really. Sitting on your hands – though possibly the right answer – is often easier said than done. Rebalancing your portfolio is a practical and prudent thing to do in this type of environment.Perhaps there is an area of your portfolio that has been overconcentrated – now might be a time to pare back an overconcentrated position and redeploy into a more diversified strategy. Maybe your long-term stock to bond ratio target is out of whack. You might have too much cash built up in your portfolio, or maybe you don’t have enough. Valuations in some asset classes and sectors are becoming more appealing from a long-term perspective – could it be time to reposition a portion of your portfolio into different areas of the market? What about that old 401(k) you haven’t looked at in years – should the allocation be changed?The simple yet vague answer to all those questions is: it depends. If your investment strategy is following any kind of process, there’s a high likelihood that recent volatility should have initiated some form of rebalancing. Hopefully, you are working with a financial advisor that proactively does this on your behalf. Your financial situation is unique to you, so no single answer is correct for all – but your portfolio could probably use some tweaks right now if the allocation has been sitting idle.It’s important to realize that rebalancing is typically just a tweak or small adjustment. We are not suggesting that you make wholesale changes to your portfolio strategy in the midst of the storm. Bold moves in times of volatility often don’t pay off over the long-term, but small incremental changes at market extremes can be beneficial over the long run, as can adjustments that are made on a regular schedule.

- Revisit your financial planIf you are going to take any action during market volatility, this is the one that may pay the biggest psychological dividends. After all, any angst that a market correction might bring likely stems from one question: “am I going to be okay?” No amount of CNBC, talk news radio, chatter among friends, or late-night anxiety sessions are going to answer that question. Simply put, the answer is found only in the things you can control. You cannot control the financial markets. You cannot influence the Federal Reserve. You cannot wish and hope your way into financial success.But you can have a plan. A financial plan is not about controlling what is going to happen – it is about deciding in advance how you will react (or not) to things that are out of your control. As mentioned before, recent stock market volatility is out of everyone’s control. But this is also true for things like emergency expenses, serious illness, job loss, and unexpected opportunities. Managing through these issues in a pragmatic way cannot be completely reactionary – you must have a long-term plan and process to turn to.So, how does a financial plan help you address market volatility and economic uncertainty?From an investment strategy standpoint, a financial plan defines the purpose of your portfolio. The motive for investing must be deeper than “beating the bank.” What does your portfolio represent? Core retirement income? Supplemental retirement income? Legacy assets to be transferred to heirs? An accumulation vehicle for future retirement? Maybe it is a combination of several of these things. Once you have a true understanding for your wealth’s core purpose, you can more methodically approach your long-term allocation targets and investment strategy. It goes without question that no one will reach their financial goals consistently if they are prone to panic & bailing on markets during uncertainty. Without revisiting and adhering to a plan that addresses the core objective of your assets, it is hard to move forward with confidence.

Source: CFP Board survey conducted by Morning Consult from September 17-18, 2019.You want your investments to align with the actual job your dollars need to accomplish. For instance, if your portfolio mostly represents a legacy that you will bequeath to children and grandchildren, you might be targeting long-term growth. Short-term volatility shouldn’t affect that – even if you are 70, the money may not be needed for 10, 20, 30 years. The money’s job in this example is to provide a level of future support for your family – not for you – and your financial plan lays out this blueprint.On the other hand, if your money represents your core retirement income, you cannot risk having all your financial resources at stake because you don’t want to be forced to sell a significant share when the market is down. This is where a financial plan comes into play. Your goal is to have a certain amount of money (let’s call it a “paycheck”) deposited in your bank account every month for the rest of your life. To accomplish this, you start by identifying the amount of short duration bonds, money market, and cash reserves that should be held to weather a market storm based on your income needs and objectives. The money’s job in this example is to provide that “paycheck” while continuing to seek some long-term growth to combat inflation and longevity risk. Your financial plan lays out this blueprint. If you are still saving for retirement, your money represents future resources you will use later in life. Assuming that your future need is somewhat far in the future, say 5-10 or more years out, market volatility is your friend. Keep accumulating shares while they are on sale! Periods such as now have historically proven to be the best time to buy stocks: buy low, sell high, remember? The money’s job here is to grow over the long-term as you make regular contributions to your portfolio, and a financial plan lays out this blueprint.These are just a few examples of what money may represent to investors. Hopefully, you are picking up on the fact that we are emphasizing the word job as it relates to your investment portfolio. The idea is to let your money work for you – to let it do its job. If you lack a comprehensive financial plan that addresses all aspects of your financial life, then you are likely unclear on what your money’s job is, and you are going to have a hard time putting it to work efficiently.

Conclusion

While the market goes up over the long-term, stocks experience annual losses approximately 30% of the time, and there is no way to control that. You can control your long-term perspective, your rebalancing strategy, and your financial plan. We incorporate and review all three of these on a regular basis with our clients. If you have concerns, now could be a good time to revisit your financial plan with us – we would be happy to discuss with you.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.